1. The Warren Buffett Way by Robert G. Hagstrom

Warren Buffett, often called the Oracle of Omaha, is one of the most successful investors of all time. The Warren Buffett Way delves into the investment strategies that made Buffett a billionaire. Hagstrom breaks down Buffett’s approach, focusing on his principles of value investing and long-term outlook. This book is a treasure trove of wisdom for anyone looking to understand the fundamentals of intelligent investing.

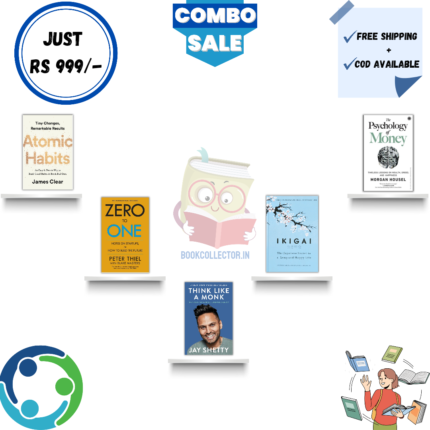

2. Zero to One by Peter Thiel with Blake Masters

Zero to One offers a unique perspective on entrepreneurship from Peter Thiel, co-founder of PayPal. Thiel argues that the most valuable businesses create something entirely new rather than merely competing in existing markets. The book explores the importance of innovation and visionary thinking, making it a crucial read for startup founders and those looking to disrupt their industries.

3. The Compound Effect by Darren Hardy

Success in business and life often comes from small, consistent actions rather than giant leaps. Darren Hardy’s The Compound Effect illustrates how everyday decisions can lead to extraordinary results over time. By focusing on the power of incremental improvements, this book provides a practical guide for achieving long-term success in both personal and professional arenas.q

4. Common Stocks and Uncommon Profits by Philip Fisher

Philip Fisher is a legendary figure in the investment world, known for his pioneering work in growth investing. Common Stocks and Uncommon Profits offers insights into Fisher’s qualitative approach to investing, emphasizing the importance of researching a company’s management and potential for future growth. This book is essential for anyone looking to delve deeper into stock market investments and identifying high-potential companies.

5. One Up On Wall Street by Peter Lynch

Peter Lynch, the renowned manager of the Magellan Fund at Fidelity, shares his strategies for individual investors in One Up On Wall Street. Lynch advocates for leveraging personal knowledge and experiences to find winning investments. He emphasizes that individual investors can outperform professional fund managers by focusing on what they know and understanding the basics of the businesses they invest in.

Reviews

There are no reviews yet.